This post is largely intended for myself. Thinking out loud, to an audience. Using the knowledge of your judgement to keep myself sharp. I hope it will be entertaining and thought provoking.

The big question remains: where will the Fed take the nominal GDP trend? If we can figure this out early, and make the appropriate reckless bets, we can make some money.

The Fed massively over-did the Covid stimulus. They’d saved the world by early 2021, yet they continued driving NGDP growth higher, blasting cash through every financial orifice in the economy. This caused excessive, damaging inflation.

I suspect the Fed intentionally caused the excess inflation, partly to reward insiders who were tipped off about it, partly to screw the Chinese before they finished unloading their Treasuries. We also gained some important information on how the US economy runs at higher levels of nominal growth. I wouldn’t have done it, but I get the case for it.

Lately, the Fed has taken NGDP growth down and inflation has followed. Now they are cutting rates. Before we go getting all excited about the rate cuts, let’s recognize the Market Monetarist wisdom about rates: they’re a terrible instrument. We should “never reason from a price change”. Just because the Fed has cut rates, doesn’t mean monetary policy is necessarily easier, and in fact, low rates are typically associated with lower nominal growth.

Through the summer of 2024 there was a tortured, excruciating back-and-forth about how much, and when, the Fed would cut. It was in the financial press, the blogs and in discussions among various business- and economy-minded people. In my view far too much was made over the precise timing and magnitude of the cut.

Much more important to keep an eye on the 5-year TIPS spread, probably the single most information-rich indicator we have to summarize the stance of monetary policy in the USA. If you squint at the chart below from 2020-2021, you can see how the Fed basically used the 5-year TIPS spread as a policy target, and then abandoned that once they started raising interest rates.

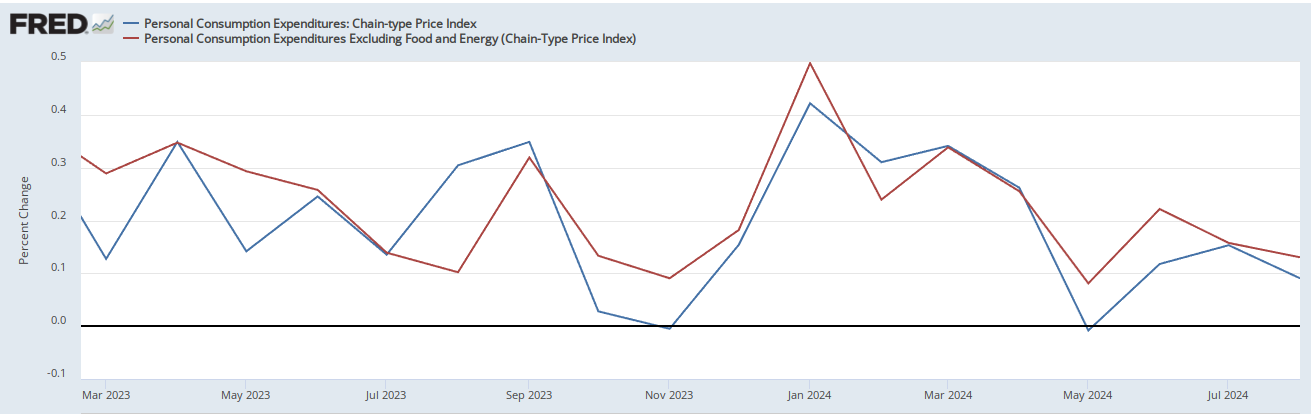

Today we got another month of PCE inflation data, for August 2024. The red line is PCE inflation less Food and Energy (“core inflation”), i.e. a “deeper” read on inflation, less noisy. You’ll note that core inflation has held at 2.6% YoY for a few months now, that’s a little deceptive in this case, due to volatility in the denominator, it makes it look like inflation is flat-lining at 2.6%.

However, if we look at the monthly change in the seasonally adjusted series, we see three months in a row of lower inflation. The new data point shows month-over-month inflation was 0.13%, which works out to 1.6% annualized, not bad.

So inflation is coming in cool, if it keeps coming in like this, in a year the YoY statistics will look really good, below 2%. When inflation stats come in below 2%, the Fed is happy, it makes them feel responsible. It’s plausible that August inflation was low because nominal spending growth is slowing in recent months. Nominal spending tends to be auto correlated, absent some major policy shift, it just keeps going as it has been going, in this case: lower growth rates.

I suspect the Fed has non-public data that shows the economy slowing, and that we’ll get confirmation of this slowing on Oct 30th when the first GDP print for the 3rd quarter comes out. At that point the 50 bps rate cut won’t look “stimulative” it will look modest. This is my hunch, my paranoid, cynical read on things.

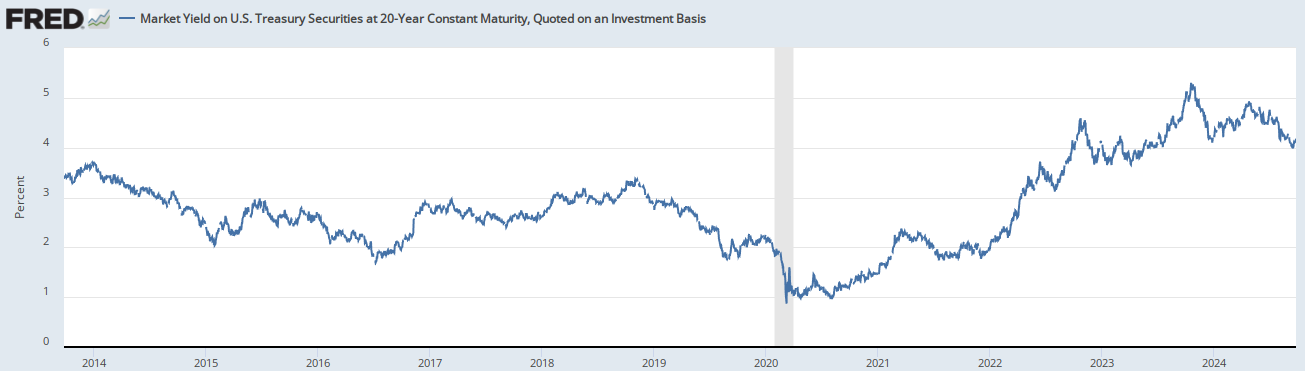

The Fed will “chase” the economy downward, with rate cuts and language that slow the rate of economic cooling. They’ll bring NGDP growth down to 4% and bank a few years of sub-2% inflation, to compensate for the blistering post-covid inflation. This will mean yields fall (good for the massively indebted US Federal Gov). If yields fall….bonds rise…and you want to be holding TLT.

I’m not selling any stocks or crapto, but I continue to build my TLT position. These long term yields just look unsustainable.