Q1 2023 Economic Update

Discount the recession hype

Time for another quarterly update on the general stance of the US economy. The TLDR is that things are pretty good, the economy is growing, and markets don’t seem to anticipate a recession, so neither should you, unless you have some unique insight or information.

The banking crisis

Yes, there’s a bit of a financial crisis. Let me tell you something about banking crises: they’re all the same. Banking is super competitive, and particularly if you’re a big bank, but not a huge bank (top 5 or so) there’s a tendency to build a highly fragile and over-optimized portfolio that blows up when there’s a sizable change in the expected path of nominal GDP (which we can’t directly observe, but can infer from asset prices).

I remember in 2008 and 2009, being a young private sector economist-type. Everyone was so confused and focused on the details. The details don’t matter. Banks took on assets, then in a relatively short period of time, the price of those assets fell and the bank became insolvent.

This is why unstable nominal GDP expectations (the common factor all financial markets seek to predict, whether they know it or not) are so destructive. We can say that markets went from anticipating open-ended 4% US nominal GDP growth in 2019, to maybe 7% nominal GDP growth by mid 2021. Such a large shift in the expected flow of spending through the economy has enormous implications for asset prices. Mortgages and even auto loans were made at sky-high collateral valuations. If those loans default, they’re at a greater risk of being underwater now. That may or may not be a problem as this crisis unfolds.

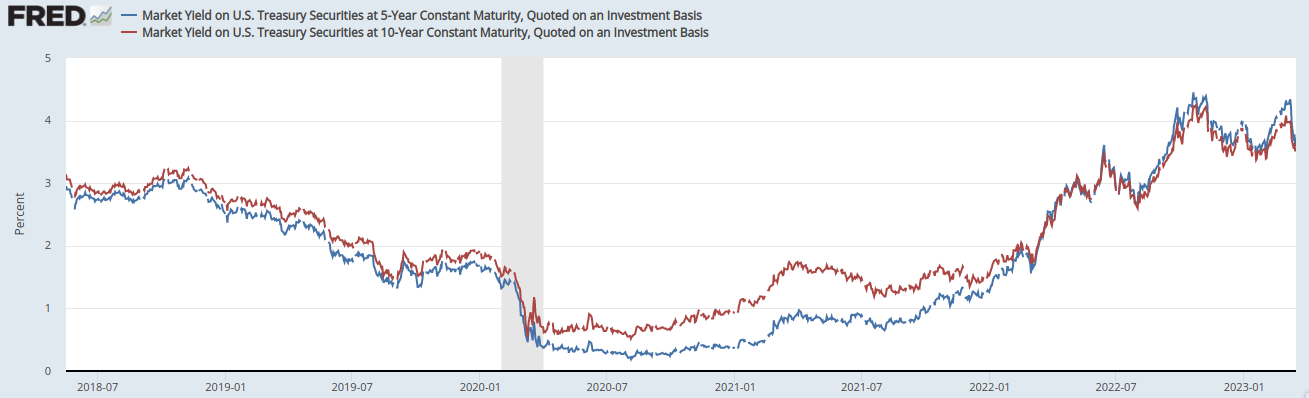

The details of this crisis, at least as it has affected SVB, are not mortgages or auto loans, but the safest security imaginable: US Treasuries. As the Fed fueled and boosted the economy in the wake of the Wuhan Virus situation, the equilibrium short term interest rate rose, and indeed the entire yield curve steepened, and then shifted upward, as you’d expect when the economy strengthens. The Fed totally overdid it of course, drove realized and expected nominal GDP way above any plausibly optimal path, but you should be able to recover from that.

The problem with the Fed’s policy is it caused inflation. Yest, yields on longer dated bonds are moderately higher then they were before the COVID recession, and so if you were holding bonds, your position became less valuable, but a bank should be able to take a moderate loss on Treasuries.

The situation with Credit Suisse is more complicated, basically that’s been a failing business for years, and this episode is the proverbial straw.

Other US banks are in trouble besides SVB. The conclusion here is that there are too many banks, and they’re strangling each other by competition. The solution is to adopt the Swedish Model. In the early 90s, Sweden’s Riksbank switched from a higher inflation, higher nominal GDP policy, to a lower inflation, lower nominal GDP policy. This caused a credit crisis, and the regulators in that land concluded the best way to avoid future crises was to have less competitive, more highly regulated banking sector. Big, lumbering, oligopolistically profitable banks can take a punch. You don’t hear about JP Morgan Chase or Bank of America having problems.

So basically let’s keep an eye on the banking news, but pay much more attention to financial markets. If you see the S&P 500 tanking 10% in a day, that’s a much bigger signal of impending recession than a big, but not quit huge bank going under.

Now let’s infer what markets think about nominal GDP

As a reminder, I am persuaded by the claims of the Market Monetarist school. I think that nominal GDP is the most important statistic, and that asset prices reflect the implicit nominal GDP forecast of disparate market participants. I like to look at TIPS spreads, the S&P 500 and commodity markets, in that order, when producing a qualitative nominal GDP expectations assessment.

In the chart below we see the 5-year TIPS spread plotted up to March 17, 2023. The 5-year TIPs spread gives us a market-implied forecast of average yearly CPI inflation in the US, over the next five years.

If we focus on the last 15 months of data we see the run up in inflation expectations, from around 2.0% in January 2021, to a totally unforeseen 3.6% in March 2022. Since that point, the Fed has brought inflation expectations down, using the ‘ratchet strategy’, two-steps-forward, one-step-backward; a classic way to lead a group along a desired but perhaps scary metaphorical path, without spooking them.

The Fed has generally tightened policy this last year, both through formal interest rate hikes and indirect (but just as powerful) off-the-cuff and official statements. However, the FOMC always tap the breaks a few days or weeks after a policy-tightening bout, so the TIPS spread shows a rather jagged pattern since March 2022. We don’t see this pattern in the 2018-2021 period, which I see as moderately strong evidence the Fed has deliberately deployed a “ratchet” strategy in 2022-2023, to systematically bring down inflation expectations.

(The chart below shows a shorter time-snip of 5-year TIPS, to give a better look at recent movements)

If TIPS spreads fall, it usually indicates expected nominal GDP fell (unless there’s some OPEC+ or other oil supply related action). The TIPS spread series shows us that the Fed has succeeded in convincing markets, implicitly, that nominal GDP growth will return to a historically normal rate, for most of the next 5 years. The lower expected inflation (between 2.1% and 2.6% in the last few months) is consistent with maybe 4.5% to 5.5% nominal GDP growth per year, about the optimal range for the USA.

4.5% expected nominal GDP growth is totally inconsistent with recession. It doesn’t mean it is impossible, there could be some disastrous supply-side shock, nuclear war, a horrible labor market law change, that causes an abrupt loss of employment and output. The Fed could screw up, or otherwise decided it wants a recession and bring nominal GDP to 2% or even lower. That could cause a recession if they hold the lever there long enough. It does mean that markets don’t foresee a recession at the present time, and all we can do without inside information on what he Fed and anyone who might have influence over the Fed intended, is to interpret market forecasts.

The big question is how much lower the Fed will bring inflation. If you know the answer to that, you can get rich. Note that our latest data point, after a week of bad banking news, has TIPS at 2.10%. Basically an external event allowed the Fed to incrementally tighten policy, through it’s slightly less dovish than expected response, (regardless if the Fed wanted that, that’s how it was taken). It’s only one day, and we did see a similar one-day dip in January. My guess is that the Fed will back off here, shedding no tears at having broken a few flimsy banks, but not in a rush to drive the economy into a ditch.

Of course the Fed could be controlled by an evil cabal who wants Trump to win, in that case, maybe they will drive the economy into a ditch. That’s what I’d do if I were in an evil cabal who wanted Trump to win. I no evidence of cabals, but so long as the Fed is not held accountable for hitting specific statistical targets, we are free to throw out unsubstantiated conspiracy hypotheses.

Bitcoin and the banking crisis

Bitcoin now behaves as a safe haven. The currency ran up from $20k a week ago, to about $28k on March 19. This is the weirdest asset: sometimes it trades off hype, sometimes it’s an inflation hedge, sometimes it’s a tech stock, and now apparently it’s a haven.

It could be that the US is seen as just slightly less of a first world country lately, and the world needs a new safe haven. We really could go deep here but I figure you can build your own convincing case on this topic.

It could also just be that Bitcoin is a strange and powerful asset, and markets are gradually finding new uses for it, namely as a Schelling Point universal store of value, which because it has no revenue stream, is less affected by unexpected fluctuations in the nominal income growth of major economies. Anyway I am glad to hold BTC and will never, ever sell.

Labor market and Retail Sales

Real quick here; payroll employment continues making new highs, job growth has held up in Q1 so far. This is really a backward looking series, but it’s still interesting to check out now and then.

Retail sales continue moving sideways, as they had through 2022. Retail had been one of the most interesting series in 2020 and 2021, as it soared far above trend, reflecting the incredible Fed-induced spending spree that drove inflation up and up. With this sustained lack of growth in retail spending, combined with TIPS spreads that as of this moment, are basically optimal, I’m just not sweating the high CPI or PCE inflation numbers. That’s most likely delayed price hikes, and I expect inflation to fall through 2023.

Trading

As I said, if you know where the Fed intends to steer the inflation rate (which is just a side effect of nominal GDP, which is what really matters), you can get rich. This is always the case, the common thing all commentators and traders try to do is anticipate the Fed. I reckon the Fed will keep inflation expectations between 2% and 2.6% for the coming year. If they do, I’ll make some money, if they don’t I’ll get burned.

As many brokerage accounts pay 4%+ interest on cash right now, I intend to park my incremental savings in cash, and keep it as such so long as TIPS spreads are above, say, 2.3%. I’ll gradually move that cash into some stocks I like when TIPS dip to around 2.2%, or maybe a little lower. I’m currently hoping to see a little more panic from this banking situation, maybe I can snatch some shares at 1.9% TIPS. The vast majority of my positions are of course long-term, multi-year “buy and holds” that I won’t be touching. We are each responsible for deciding how to steward our wealth, so don’t go trading of what I say.

I’m betting Fed has been shaken of it’s Bernanke-Yellen era obsession with keeping inflation ultra low. The FOMC is now largely composed of people who were too young to be into economics during the 1970s inflation epoch, and although Powell was old enough, he’s not really an econ guy, but a banker. The macro economist profession is still averse to inflation, but my sense is they’re not as monomaniacal about it as people born in the 1940s or 1950s. They don’t see “2%” as a magic threshold.

The de facto 2% inflation ceiling policy is now dead, but we don’t know what the new regime will be. Given how much better the real economy performed in 2022 compared with say 2014 or 2016 (roughly the nadir of the ultra low inflation Yellen years), and how rapidly the economy recovered under Powell’s aggressive, inflation-tolerant policy, compared with the anemic, tortured recovery from 2009, I bet on the Fed implicitly targeting CPI inflation a little north of 2%.