End of 2022 Economic Update

I’ve neglected to do an economic update post for too long. I’ll aim here to say something I think is true and useful, rather than try to say everything.

The US economy has certainly slowed in recent months, but from too fast a pace, so it’s welcome news. I’m not really interested in debating whether this merits the label “recession”. It may or may not, but there haven’t been mass layoffs as in the sort of recessions most people care about.

Much of what we do when trading short term, or forecasting macro aggregates, is anticipating what the Fed will do. I never dreamed the Fed would tolerate such high inflation as we saw in 2022, which was entirely predictable by mid-2021. This is why my forecasts have been consistently wrong, thinking the Fed would never be so reckless.

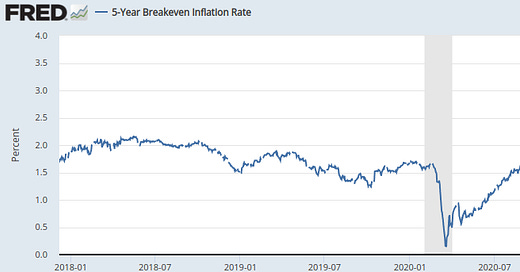

The Fed is steadily correcting the situation. Below we see our familiar friend, the 5-year TIPS spread. Recall the 5-year TIPS spread tells us what the bond market expects for inflation, on average, over the next five years, our best forward looking indicator.

In this chart we can see the “normal”, pre-covid Fed policy of keeping inflation expectations below 2%. In 2021 we see a strong rebound in inflation expectations, a rebound which grows out of hand by early 2022. Since the spring however, the Fed has steadily tightened policy, and brought inflation expectations down to the current level of 2.33%.

They could leave inflation expectations here, and everything would be fine, we could endure 2.3% inflation certainly. I think they will probably bring them a little lower, but higher than in the pre-covid world. This means higher nominal interest rates, and probably slightly higher real rates as well, as the pre-covid monetary policy regime was slightly suboptimally tight.

Retail Sales and GDP

Let’s look at the trend for retail and food service sales

Again we see the familiar pattern of a “level” shift upward from the pre-covid trend. Massive retail sales growth in 2021, brought us well above the pre-covid trend line. Recent tightening in monetary policy however has slowed the growth in retail sales, leaving it still at a high level. The near flat-line in retail spending since about July 2022 (right at the end of the chart) explains why measured inflation has come down: stores and restaurants have already increased prices markedly, and so with little new sales volume, there’s little need or scope for further price increases.

I expect 2023 will see retail sales growing about as much as they did pre-covid, about a 4% to 5% annualized pace.

The last plot I want to review with you is nominal GDP, i.e. total dollar-spending on final goods and services. This quarterly frequency series is less volatile than the others we’ve looked at.

For reference, nominal GDP in the USA, between the Great Recession of 2008, and the covid crisis, grew around 3.5% to 4% per year. This was probably slightly too low a rate of growth to optimize real economic output, but it did lead to the lowest period of inflation since the USA adopted a fully fiat currency. In the rebound from the covid crisis, you can see the steepness of the line increases markedly. In this period nominal GDP is averaging a 9%+ yearly pace. If you figure the economy can only realistically grow 2% or 2.5% yearly, that means we’d have at least 7.5% trend inflation if this pattern continued indefinitely.

Nominal GDP growth has slowed a little in the last few quarters, but was still 7.3% annualized in the third quarter. This would be a worrying sign for inflation, however we can see the market isn’t worried, as TIPS spreads have come down (first chart). I expect nominal GDP growth to slow a lot in 2023 and perhaps do 4% or 5% for the full year. I think once the drop in housing starts hits the construction sector data, we’ll see GDP growth really decline.

Conclusion

Mostly looking at the TIPS spread, I conclude the Fed is deploying a ratchet strategy of tighten/relax/tighten, to pull down expectations for nominal growth, and return the US economy to a basically normal level of inflation. The cost of this strategy is that it takes longer than abruptly correcting course. We’ve endured a great deal of inflation as a result, which has de facto transferred wealth from cash, and low-beta asset holders, to debtors. People who took out mortgages at the top of the red-hot real estate market may also get burned.

2023 will usher in a period of economic consolidation as households and firms implicitly re-calibrate their inflation and income-growth expectations. I’m not expecting much from broad stock indices, but also not expecting a true recession, characterized by broad and deep layoffs.